Form 3520-A, Annual Information Return of Foreign Trust With a U.S.Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.Form 3115, Application for Change in Accounting Method.Form 2678, Employer/Payer Appointment of Agent.Form 1128, Application to Adopt, Change or Retain a Tax Year.Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship.Income Tax Return for Settlement Funds (Under Section 468B) Income Tax Return for Regulated Investment Companies Income Tax Return for Real Estate Investment Trusts Property and Casualty Insurance Company Income Tax Return Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons.Life Insurance Company Income Tax Return Form 1120-IC DISC, Interest Charge Domestic International Sales – Corporation Return.Income Tax Return for Homeowners Associations Income Tax Return of a Foreign Sales Corporation Income Tax Return for Cooperative Associations Income Tax Return for Real Estate Mortgage Investment Conduit Form 1042, Annual Withholding Tax Return for U.S.Form 730, Monthly Tax Return for Wagers.Gift (and Generation-Skipping Transfer) Tax Return Estate (and Generation-Skipping Transfer) Tax Return Form 706 Schedule R-1, Generation Skipping Transfer Tax.Estate Tax Return for Qualified Domestic Trusts Form 706-GS(T), Generation-Skipping Transfer Tax Return for Terminations.Form 706-GS(D-1), Notification of Distribution from a Generation-Skipping Trust.Form 706-GS(D), Generation-Skipping Transfer Tax Return for Distributions.

#Electronic signature registration

Form 637, Application for Registration (For Certain Excise Tax Activities).Form 11-C, Occupational Tax and Registration Return for Wagering.The IRS allows taxpayers and representatives to use electronic or digital signatures on these paper forms, which they cannot file using IRS e-file: E-signatures on certain paper-filed forms

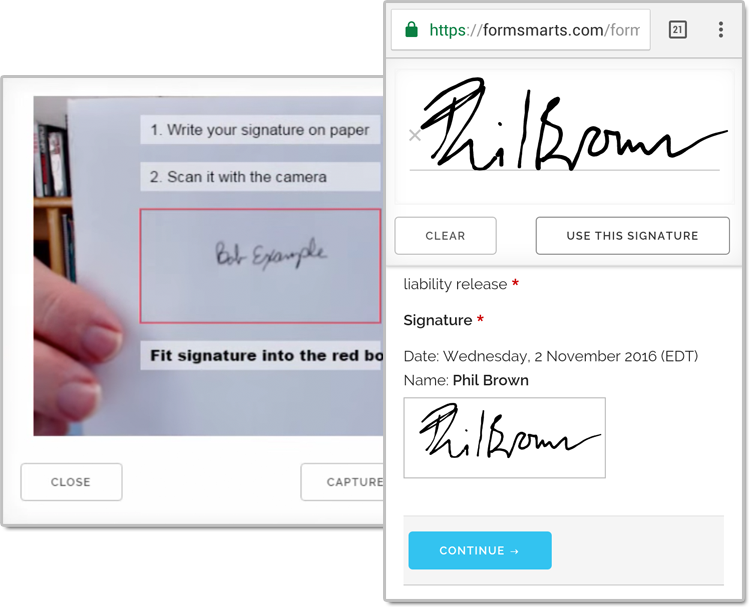

The IRS will accept images of signatures (scanned or photographed) including common file types supported by Microsoft 365 such as tiff, jpg, jpeg, pdf, Microsoft Office suite or Zip. The IRS doesn't specify what technology a taxpayer must use to capture an electronic signature.

#Electronic signature software

An electronic signature is a way to get approval on electronic documents. The IRS will accept a wide range of electronic signatures.

Types of acceptable electronic signatures Understanding the importance of electronic signatures to the tax community, the IRS offers an overview about using them on certain forms. The agency is balancing the e-signature option with critical security and protection needed against identity theft and fraud. To help reduce burden for the tax community, the IRS allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically through December 31, 2021, and the IRS is studying possible further extensions of this option.

#Electronic signature pdf

The IRS has updated its temporary policy PDF on using e-signatures for certain forms.ĭate now extended to October 31, 2023, for using electronic signatures, Form 1042 added to list of forms. Updated: DecemElectronic Signature Extended We’re working to extend the temporary policy to allow e-signatures for certain forms beyond October 2023 while we develop long-term solutions for this capability.

0 kommentar(er)

0 kommentar(er)